The end of Credit cards

I discovered yesterday on my holiday in the US that the magnetic strip on my debit card doesn’t work. The experience has me wondering (hoping) about when we will do away with physical plastic cards for payment all together.

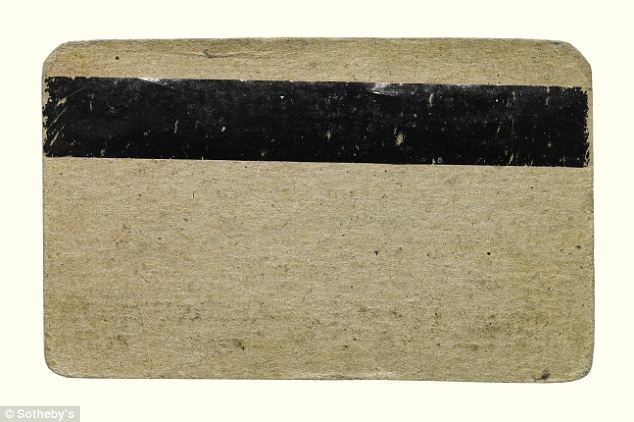

In Australia, I rarely carry cash. I use my debit card to pay for almost everything, and when I do use the card it is always tap payment. So when I came to the US, there were some awkward looks when tapping and rubbing my debit card against the readers had no effect. I then watched the clerks unsuccessfully attempt to read my card’s worn magnetic strip.

My card’s magnetic strip had become a barrier between money in my bank account and the object or service of my desire. If there is one thing we know about society, we are good at using technology to remove barriers to our consumption.

Credit cards are a recent and rapidly changing phenomenon. Formally introduced in the 50s, there have been a few advances in card reading technologies as we moved from physical carbon imprints to magnetic strips to readable chips.

The next evolution could be considered payment through smart phones. UNSW economics professor Richard Holden published a piece in the Financial Review about “How to make Australia cashless by 2020.” An article in the Financial Times notes an increasing rate of decline of cash payments in the UK (“How long will you have pounds in your pocket?“). An NPR article explains how China is leap frogging credit cards straight to mobile (“In China, a cashless trend is taking hold with mobile payments“).

Mobile payments however are only a stop gap as we move to embedded technology. Credit cards had a shelf life of around 80 years and mobile payments started around the 90s. Mobile payments can be expected to rise and fall then around the 2050s accounting for increasing rates of technology and time required for generational changes in our society.

In a picture of science fiction becoming reality, I reflect on the premise of the movie In Time. The movie describes a situation where every person is born with a clock embedded into their wrist. They pay for goods and services with time, tapping their wrist against readers and each other.

In a manifestation of the idiom “time is money”, our financial worth is stored in virtual accounts. Like in the movie, we will continue to remove physical barriers of transferring our worth in exchange for value until thought and action are nearly instantaneous.

I write this reflecting on my current focus of measuring innovation activity. Startups focused on financial technology are creating the future now address all aspects of the sector, including payments, insurance, banking, security, and more. A side question is how fintech can then help alleviate poverty in developing countries and other examples of fintech startups addressing poverty in general.

I am not sure if I will be around for widespread adoption of embedded transactions, but it will be exciting to watch and contribute to the evolution. Until then, I better go order a replacement debit card.